Every business has invisible weight slowing it down—workarounds that became permanent fixtures, outdated workflows that nobody questions, and quick fixes that were never revisited. This hidden drag on organizational performance is called process debt, and it's costing companies millions in lost productivity, employee frustration, and competitive advantage.

Understanding Process Debt

Process debt refers to inefficiencies, waste, and redundancies that accumulate in workflows over time. Unlike technical debt—which involves outdated code and lingering software bugs—process debt centers on operational workflows that have become bloated by patchwork solutions and temporary workarounds that have become permanent fixtures. As business consultant Steve Priestnall explains:

"Process debt is the result of implementing a process tactically to overcome an issue such as a change in working practices, a lack of system functionality or a disconnect between a job role function and the ability of the system or application to deliver the outcome required".

The challenge is deceptively simple: organizations prioritize speed and convenience over strategic process design. When a new tool gets added to an existing workflow without auditing that workflow first, process debt multiplies. Many businesses believe software alone will modernize their operations, but that thinking is fundamentally backward—no tool can fix a broken underlying process.

The Real Cost of Workarounds

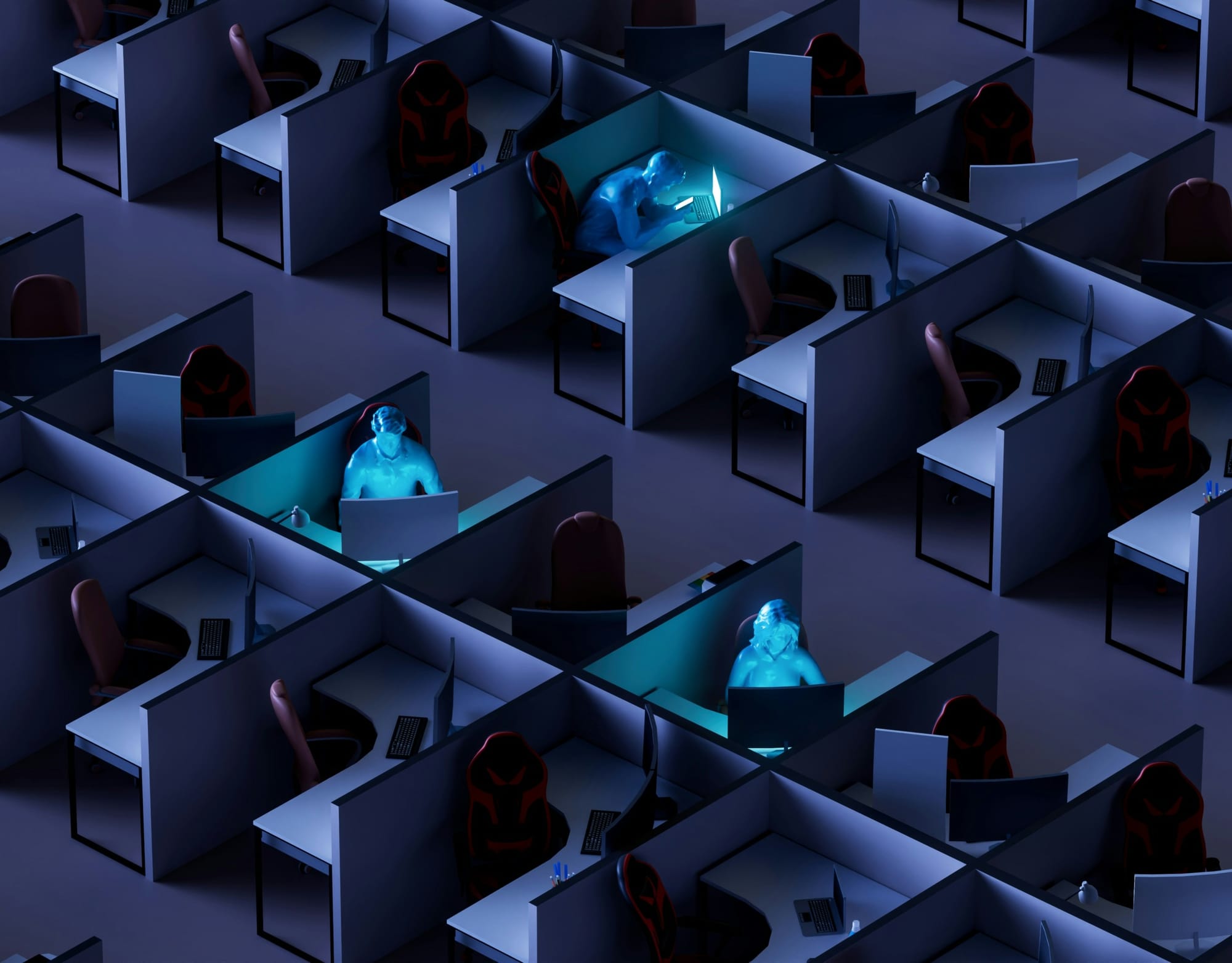

The most common manifestation of process debt is in workarounds, those "temporary" solutions employees create to navigate inefficient systems. These shortcuts operate in isolation rather than holistically within the broader process ecosystem. Over time, process debt slows systems down, creates operational inefficiencies, reduces organizational effectiveness, and decreases overall business value.

Consider automation as a prime example: many organizations treated it as "set it and forget it" technology, racing to automate everything possible without ever revisiting those automated workflows. Years later, these companies discovered their automation was running on outdated assumptions, performing unnecessary steps, and creating bottlenecks rather than eliminating them.

Breaking the Cycle

Reducing process debt requires deliberate commitment to continuous improvement and regular business process analysis. A workflow that functioned efficiently last year may be completely misaligned with current expectations, resources, and tools. The solution starts with regular audits: if you haven't examined a process from beginning to end recently, bottlenecks and unnecessary actions are likely hiding within it.

Organizations must resist the temptation to layer new technology onto broken processes. Instead, they should invest in strategic solutions fully aligned with operational and business strategy, updated to reflect current user and customer requirements. Process debt assessment tools and workflow mapping exercises can reveal exactly where inefficiencies exist and which workarounds are subverting compliance regimes or invalidating documented processes.

The most successful approach combines proactive prevention with systematic remediation—much like financial debt management requires both reducing existing obligations and avoiding new ones. Companies that embrace this dual strategy transform process debt from an invisible tax on performance into a manageable element of operational excellence.

Discussion