Americans are tightening their belts everywhere except one surprising place: the checkout line for "microluxuries." From $18 peptide lip balms to $7 specialty lattes, consumers across the United States are embracing small indulgences while cutting back on major purchases. This emerging "treat economy" represents a fundamental shift in spending behavior, reshaping retail strategy and revealing more profound truths about consumer psychology in uncertain times.

The Psychology Behind the Splurge

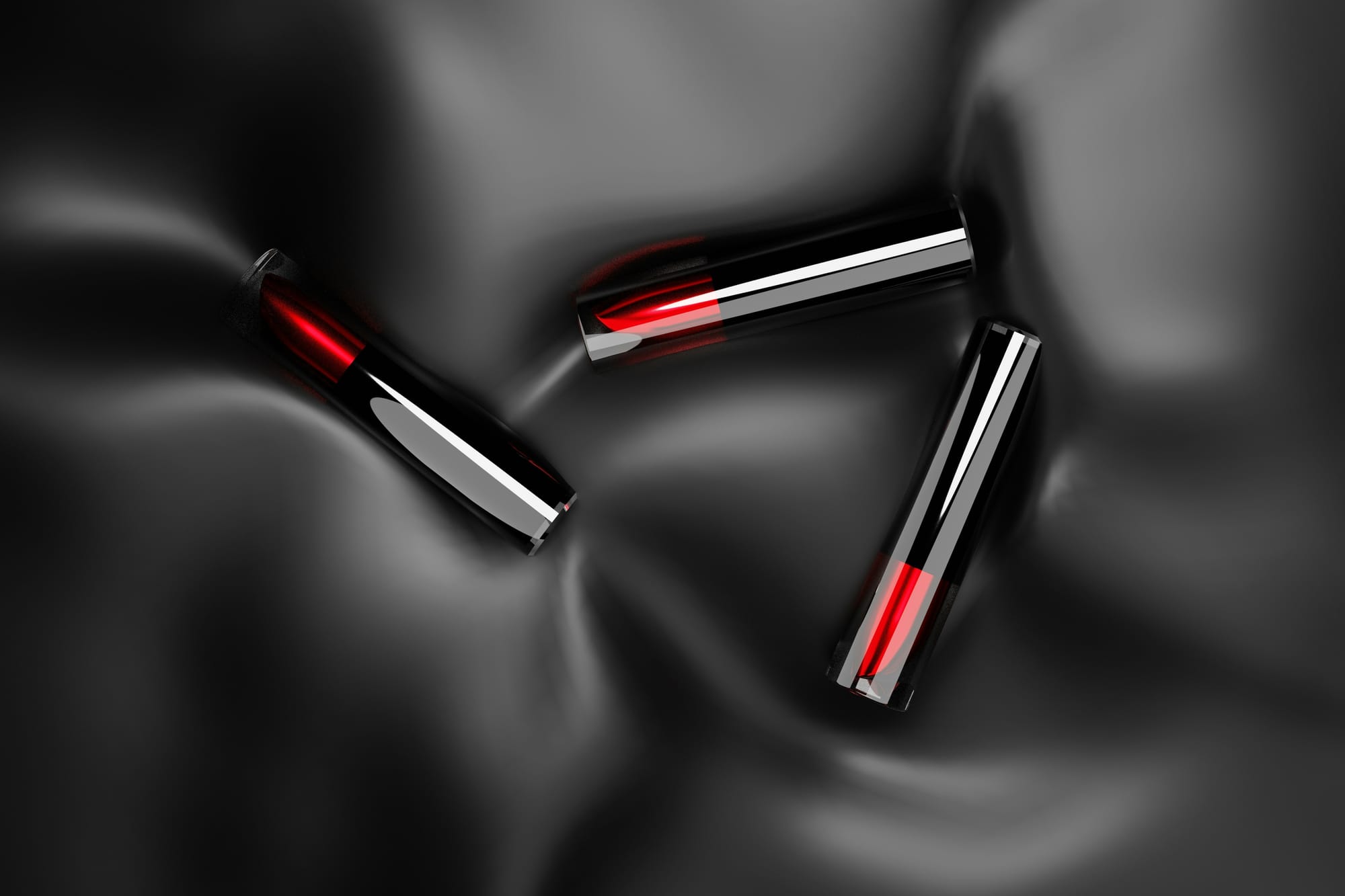

The microluxury phenomenon isn't financially irrational—it's emotionally strategic. Research from Deloitte found that 64% of consumers are more likely to purchase products that make them feel emotionally secure, even when those items aren't essential. Peter C. Earle, senior economist at the American Institute for Economic Research, explains that buyers often reward themselves for enduring harsh economic conditions by upgrading their personal goods and services. This behavior echoes the classic "lipstick effect," coined by Estée Lauder heir Leonard Lauder, which describes how consumers pivot to affordable luxuries during downturns.

The numbers tell a compelling story: 57% of Gen Z purchases a "small treat" at least once a week, with 1 in 5 buying daily indulgences. Nearly three-quarters of Americans—73%—say small luxuries are critical to their quality of life, and 62% consider them essential to self-care routines. These purchases serve three psychological drivers: reward (feeling earned after stressful days), control (reclaiming agency when prices rise everywhere), and mood enhancement (seeking dopamine hits through accessible pleasures).

How Businesses Are Capitalizing

Retailers are rapidly adapting to this shift in consumer priorities. Major department stores like Macy's have pivoted their strategy to feature both high-end and "off-price" luxury items year-round, including proprietary makeup brands designed to deliver prestige at lower price points. Ethan Chernofsky, senior vice president at intelligence platform Placer.ai, notes that consumers are becoming more discriminating, creating distinct categories between necessities and "affordable luxuries" they're willing to prioritize.

The affordable luxury market is currently valued at approximately $250 billion globally, with robust growth in North America. Consumer spending on personal care products reached over $200 billion in Q2 2024, up from $193 billion the previous year, signaling increased willingness to invest in self-care categories. Analysts at Deloitte predict continued spending growth in specialty foods and beverages, premium spirits, wellness products, and beauty items—all falling into the microluxury category.

The Long-Term Business Implications

This trend extends beyond generational quirks or temporary economic reactions—it represents a permanent recalibration of consumption patterns. Younger consumers are adopting what researchers call "strategic spending" or "frugal luxe," trading down on groceries and subscriptions while maintaining identity-affirming purchases. A Bank of America report confirms that Gen Z views these purchases not as frivolous spending but as calculated decisions that balance financial constraints with emotional needs.

For businesses, understanding microluxuries means recognizing that today's consumers perform "economic self-optimization" rather than passive consumption. Brands succeeding in this environment offer products that deliver both tangible quality and intangible emotional value—positioning small purchases as instruments of identity, control, and self-worth rather than mere indulgences. As economic uncertainty persists, the companies that master this balance will capture loyalty from consumers seeking affordable ways to maintain aspiration and joy in everyday life.

Discussion